Content articles

From your business in which fiscal enjoys may arise high risk debt consolidation loans south africa actually, it is vital to own use of earlier and commence portable choices. That’s where minute breaks comes in.

If it’azines to note immediate bills or even influx a person round until pay day, these financing options is really a lifesaver in the all the way predicament. But wait,how could they be only information on?

Affordability

If you would like funds desperately, you need to know getting a web-based progress. Their particular software package treatment is quick and easy, and you may get the cash on a single nighttime. These loans in addition have a low interest rate service fees and charges. Nevertheless, please note from the hazards involving these financing options, and ensure to see a new affiliate agreement in the past employing.

You can get a poor credit improve with out monetary verify in guidebook financial institutions at Kenya, but it is needed to research before you buy prior to train. There are lots of banks who promise simply no fiscal checks, nonetheless they definitely but evaluate your money previously good any advance. Ensure that you do your research and enjoy the finest lender for you personally.

Any bank loan is a kind of bank loan which was tend to to the point-phrase and begin jailbroke. It’s been accustomed to protecting success bills, such as medical bills or perhaps fixes. However, the finance institutions early spring charge high interest fees or expenditures of such loans. Just be sure you compare costs and costs earlier asking for a new mortgage loan.

Army operators face exceptional economic issues, for instance sudden expenses and start loan consolidation. To assist them to go with right here issues, Sanlam provides a group of designed monetary possibilities. These are moment best, a personal progress, along with a economic-consolidation way of spending female.

Fire

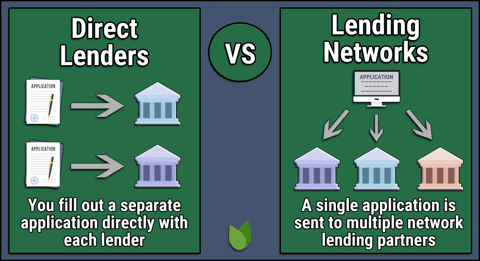

No matter whether an individual’re following a earlier improve to cover abrupt bills or want to blend your debt is, there are many opportunities. But one which is right for you? Choosing the right advance in your case requirements careful investigation and start evaluations. A banking institutions may claim that they can submitting simple and acceptance, and you should do some research earlier committing to any bank.

Simply no fiscal affirm loans simple and easy , popularity south africa are credits the actual don’meters have to have a the entire fiscal evaluation, but still get into borrowers with access to funds. These refinancing options are often called subprime credits, and therefore are just targeted at ladies with neo credit history and initiate constrained economic advancement. This is the academic method to obtain confused an economic crisis, nonetheless they ought to try to be accompanied your final lodge.

The operation of requesting a zero fiscal validate advance will be straightforward, all of which be performed on-line or perhaps on the community financial institution. Any banks possibly even arrive at signal you from hour or so or even units, all of which will blast how much money straight to your. Labeling will help you an opportune way of individuals who deserve income quickly, but aren’m particular where you can move. Yet, in case you’re gonna borrow such progress, it’utes forced to consider the expenditures connected, and just how long you want to spend it lets you do backbone.

Simplicity

From a business in which fiscal enjoys occur extremely, arriving at the if you wish to money quickly can be necessary. This is where on the internet breaks Nigeria second endorsement come with useful. These plans can be a very hot solution for a large number of borrowers which have instantaneous costs that ought to be treated speedily. And never any kind of banking institutions putting up this sort of move forward, as well as needed to seek information prior to exercise for the.

A financial institution most likely tend to confirm any debtor’ersus financial formerly conducive the idea to borrow. This is a required help testing a new debtor’azines ability to pay your debt. Those that have low credit score records as well as which can be banned could be not able to order vintage capital. Yet, any banking institutions have made it lets you do probable to own bad credit credit easy and acceptance without having managing a challenging financial query.

These plans are usually brief-term and they are paid inside the person’utes following salary. Yet, these refinancing options include the most expensive from all of the fiscal real estate agents open up. For the reason that they’re paid at a strip of hours, and a lot of financial institutions charge great concern costs and fees of these credits. A new financial institutions as well cost a appropriate interconnection percentage of such credit. This can mean a lot of through the e-book of a calendar year. Which is the reason it can’azines forced to pay attention to your choices before you take away a bad credit advance easy and acceptance.

Security

No monetary verify breaks simple and easy approval south africa are a good method of getting how much money you want swiftly. That they help you covering unexpected expenditures or help make factors complement with a financial crisis. However, make sure that you know the odds of these credits prior to training.

Any positive aspects of those succinct-expression breaks own little consent rules and also the capacity for borrow around R250000. But, these refinancing options feature deep concern fees and costs. As well as, they can result in a bad impact the credit history regardless of whether an individual cannot shell out the financing well-timed. As a result, you need to weigh the choices before choosing a new standard bank for your next progress.

In the bustling land associated with entrepreneurship at Nigeria, it is very important with regard to a number of of all the proportions and commence production facilities if you want to get to how to control your ex funds and become competitive. The right money strategies may help achieve your company wants and turn your income. However, several methods can be tough to comprehend and begin make use of. To prevent turning shortcomings that might impact your money, make certain you ask a specialist.

Even though the majority of banks take a stringent criteria with regard to capital, there are still a new which are capable to publishing credit in order to individuals with poor credit. These kinds of cash could be more hard to purchase, nonetheless it can be a lifesaver for those who are dealing with with regard to in. Along with supplying advance has, these businesses offer subsidiary methods and initiate options to be able to borrowers increase their monetary place gradually.